Spencer Platt/Getty Images

- The US' massive stimulus response and a unique labor shortage are fueling stronger price growth.

- Yet the US is recovering faster than its peers and enjoying an unprecedented demand boom, JPMorgan said.

- This soaring inflation is a byproduct of the country's "exceptional" recovery, the bank said.

- See more stories on Insider's business page.

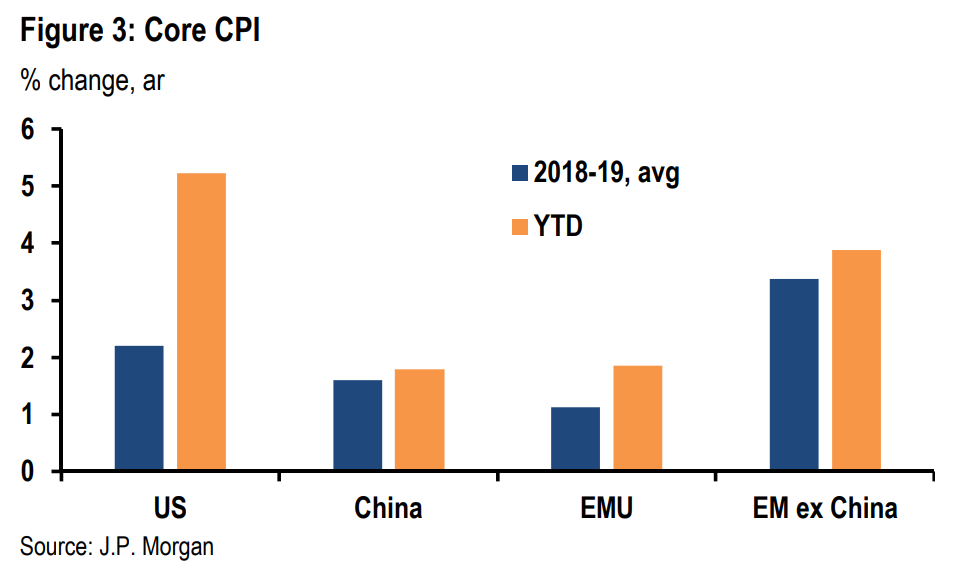

Inflation in the US is handily outpacing that of other advanced economies, and it's probably thanks to the country's stellar recovery, JPMorgan economists said.

With vaccines rolling out and lockdown measures slowly being lifted, the global economy is on the mend. Advanced economies lead the pack, benefitting from massive stimulus measures and more efficient vaccine distribution. Within that group, the US is among the best performers. The country's economic output is expected to grow at the fastest rate since the 1950s, and some banks are already revising their estimates for 2022 growth higher on hopes for an even smoother rebound.

Yet concerns of soaring inflation have offset some reopening optimism. A popular gauge of US price growth rocketed 0.6% month-over-month in May and 5% year-over-year, exceeding estimates and marking the largest one-year leap since 2008. Where the Federal Reserve has said it expects the overshoot to be temporary, supply bottlenecks threaten to accelerate inflation further through the year.

JPMorgan

The latest inflation readings are unusually strong, but are likely a byproduct of the US' outperformance, the JPMorgan team led by Bruce Kasman said in a Friday note. Where the World Bank expects advanced economies to grow 5.4% in 2021, it sees US GDP expanding 6.8% and outpacing peers through the following two years.

The strength of the country's rebound explains why inflation bounced back so suddenly, the team said.

"Although core inflation is tracking above the pre-pandemic pace elsewhere, the US has been exceptional for a number of reasons," the JPMorgan economists added.

For one, the country's service industry was hit particularly hard by the pandemic. Services prices dropped a full 2% at the peak of the downturn, surpassing the damage seen in other advanced economies.

The US also embarked on a far more ambitious stimulus rollout. Congress approved roughly $5 trillion in fiscal support during the health crisis. Much of that aid came in the form of direct payments and bolstered unemployment benefits. Once the country began to reopen, that support drove a demand boom that quickly lifted spending above its pre-pandemic peak. By contrast, spending remained weak in Western Europe, where stimulus wasn't as large or direct, JPMorgan said.

Trends in the US labor market also contributed to the country's strong recovery and faster inflation, the team added. Where employers laid off workers en masse at the start of the pandemic, they're now rushing to rehire and service an unprecedented wave of consumer demand. Job openings soared to a record high in April, but the budding labor shortage also saw quits hit a record and payroll growth slow sharply.

The imbalance between worker supply and employer demand has since driven wages sharply higher as businesses struggle to attract workers. The jumps in labor costs and households' purchasing power will further lift inflation, the economists said.

That pick-up isn't to be feared, according to the Federal Reserve. The central bank has said it will let inflation run hot in hopes of driving stronger employment and wage growth through the recovery. President Joe Biden similarly praised the trend in a late-May speech, saying the jump in average pay is a "feature," not a bug, of the US recovery.

Still, the Fed has hinted it has thought about pulling back on some of its monetary support. The Federal Open Market Committee is expected to maintain its accommodative policy stance but hint at plans to taper its emergency asset purchases when it concludes its June meeting on Wednesday.

Policymakers will likely recognize the spike in inflation rates but maintain that the economy remains far from the Fed's "substantial further progress goals," JPMorgan said. The first post-pandemic rate hike will probably arrive in late-2023, the team added, leaving plenty of time for the Fed's ultra-easy policy to drive the recovery that JPMorgan is calling "exceptional" forward.